Analyzing Week One of Google Search's Antitrust Remedies Trial

Karina Montoya / Apr 29, 2025Karina Montoya researches and reports on broad media competition issues and data privacy for the Center for Journalism & Liberty at the Open Markets Institute in Washington, DC.

Google and the US Department of Justice returned to federal court on April 21 for the remedies phase to dismantle Google’s monopoly over search, as Judge Amit Mehta ruled last August. The first week of this trial showed a stark contrast between the DOJ and Google’s positions on the scope of penalties for breaking antitrust law in digital markets.

While the DOJ is focused on showing the feasibility of its proposed remedies, Google is unmoved in its disagreement with the judge’s ruling, reflecting the tech giant’s intent to appeal it after the remedies phase is over. Thus far during the trial, Google has not offered specific alternatives to the various DOJ’s proposals, except for agreeing to end exclusive agreements that require Apple, phone manufacturers that license Android, and browsers to preload Google products by default, while still preserving the option for the company to continue to make payments to those parties for distribution and placement of its products and services.

During opening statements, DOJ’s lead attorney for the case, Daniel Dahlquist, emphasized that remedies to undo an illegal monopoly need not be frozen in time, and that they can go beyond the specific conduct found as proof of monopoly power to prevent further monopolization of related markets.

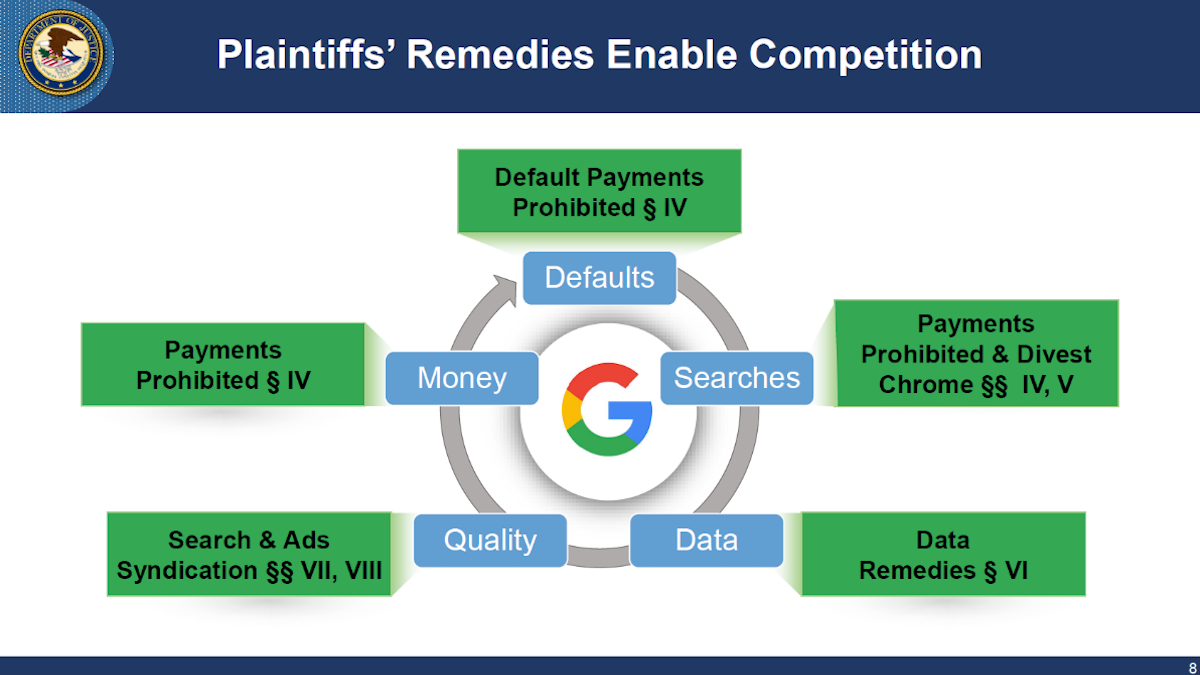

Slide from Department of Justice's Opening Statement (April 21, 2025)

“If a remedy was only able to begin and end with the specific practices without eliminating the consequences of the illegal conduct […] that would leave plaintiffs having won a lawsuit but lost a cause. We're not here for a Pyrrhic victory. We are here to restore competition to these markets,” said Dahlquist in a direct response to Google’s criticism of the DOJ’s proposal, which it deems part of a “radical and overreaching” agenda.

Chrome Spin-Off: Open AI, Perplexity, Yahoo Ready to Make a Bid

The DOJ’s proposal to divest Chrome was in the spotlight during week 1. This structural remedy targets Google’s self-dealing practices, which secured widespread distribution of its search engine. Chrome is now the world’s most-used browser and a key data collection channel for Google. The proposed divestiture would also complement a proposal for a choice screen mandate, which the DOJ supports but deems insufficient to prevent future self-dealing conduct from Google.

Market players taking the stand were quick to say they would buy Chrome if it were available for sale. OpenAI, Perplexity, and Yahoo all expressed interest as part of their testimony. OpenAI and Perplexity are both AI companies that don’t directly compete in search today, but are seeking more distribution channels and building their own web indexes. Yahoo, a once-leading search engine, is now better known for Yahoo News and other news media divisions. Global asset manager Apollo bought Yahoo from Verizon in 2021 for a reported $5 billion.

Open AI’s Head of Product, Nick Turley, testified about three key problems for the company’s growth: Google doesn’t allow other AI assistants to get seamless distribution on Chrome; Google’s content agreements with web publishers preclude rivals from getting better terms than Google; and that Google rejected OpenAI’s bid to access Google’s API to ‘ground’ ChatGPT’s responses with more updated information from Google’s search index.

Perplexity’s Chief Business Officer, Dmitry Shevelenko, said the company’s focus is on mobile distribution, but that some phone carriers “cannot work around their obligations with Google” to preload Perplexity. He added that if it weren’t for this trial, “phone carriers wouldn’t even be having conversations with us.” Shevelenko closed his testimony, saying Perplexity “fears retribution from Google” for participating in these proceedings.

Earlier that day, Perplexity published a blog post opposing a break-up of Chrome and Android and advocating for letting “phone makers and carriers offer their customers what they want without fearing financial penalties or access restrictions.”

Similarly, Yahoo’s general manager for search, Brian Provost, testified that Yahoo, with the backing of Apollo, would also make a bid for Chrome if a divestiture were mandated. Provost also said Yahoo would set its own search engine as the default on the browser and use it to “render and distribute” other Yahoo products.

Google’s stance is that no one but Google can run Chrome, and that a spin-off will inevitably hurt other Google products and user security. DOJ’s technical expert, Harvard computer science professor James Mickens, said the opposite was true. Parisa Tabriz, Google’s general manager for Chrome, warned that currently 90 percent of Chrome’s open-source code comes from Google, and that other companies make little contributions to it.

Gemini: Google Pays (Again) for Preloads on Samsung, Default AI in Chrome

The DOJ is also trying to make the case that Google can and will attempt to extend its search monopoly to AI-assisted search. Google has already integrated its Gemini model into search and replaced its Google Assistant on Android. Plus, Gemini is also a stand-alone app. The DOJ is requesting that the ban on payments that Google makes to Apple and Android to secure its search index distribution also cover Gemini.

The DOJ revealed that Google continues to use the same agreements ruled illegal by Judge Mehta to push Gemini on mobile: Google has been paying “an enormous amount of money” to Samsung since January to preload the Gemini app, according to the DOJ. Google’s vice president of platforms & device partnerships, Peter Fitzgerald, later testified that under new agreements, other rivals — Meta, Microsoft, OpenAI, Perplexity, etc. — are now in talks with the same phone manufacturers and wireless carriers that Google has deals with, and that they could potentially all coexist at the same time on phones.

But the DOJ showed that Google had only decided to amend its original agreements a week before the start of this trial. Per Google’s own records, before Judge Mehta ruled in August 2024 that such agreements violate antitrust law, the tech giant was getting ready to make its exclusivity agreements more restrictive, requiring preinstallation of Gemini the same as with Chrome and Google Search, said the DOJ.

We also learned that Google relies on its search index and user data to make its AI assistants and other LLMs work. Documents showed that search data was used to pretrain the AI model that underpins Overviews AI on Google Search, and that the search index helps improve the Gemini app, even if not all of Gemini’s output currently depends on updating its LLM in real time. While discussing the inner workings of Chrome, Google’s executive Parisa Tabriz also confirmed that Gemini is currently Chrome’s default AI assistant.

Putting this evidence all together, the DOJ seems to have made a strong point that Google’s AI business could not be where it is today, and Gemini is unlikely to have as many distribution points today and in the future, if it weren’t for Google’s search monopoly and Android.

Opening Google’s Search Index: The Hidden Force of Data Sharing

While much of the trial’s focus so far has been on revenue-sharing agreements and Chrome, the DOJ is also proposing that Google be forced to share search query results and other data signals in real time with rivals through a syndication license. Such a license would also allow competitors to use Google’s search data to build their own indexes and apply their own algorithms to display search results differently from how Google does.

Gabriel Weinberg, CEO of privacy-focused search engine DuckDuckGo, said he did not see a “silver bullet remedy” in this case, but rather a package that can “simultaneously address [Google’s] various independent scale and distribution advantages.” On gaining scale, Weinberg emphasized that a syndication license would first help DuckDuckGo to close the gap in their understanding of less common queries that only Google knows due to its monopoly; in the long term, it would help companies build their own search index.

Without this license, “even with other data remedies, if you’re asking competitors like us or new ones to create indexes from scratch, it’s going to cost upwards of a billion dollars and take many years to roll out. Whereas if you have syndication licenses, they would have a built-in business model, start acquiring users, reinvest in that user base, and then fuel that data into building the long-term indexes that they need,” he explained.

OpenAI’s Nick Turley gave similar testimony when asked about accessing Google’s search index. Turley said OpenAI did not originally conceive ChatGPT to be an AI chatbot, but to act as a “super assistant” that would be able to search the web, generate new code, or make restaurant bookings. For an AI language model to respond to queries involving real-time or recent information, access to search technology is a “necessary component,” Turley said.

He also mentioned that OpenAI is building its own search index, but the company is likely to take several years before it can entirely depend on it. Part of the problem is that web publishers depend on Google for traffic; Google can “outspend” OpenAI in content deals with web publishers, and such deals often prevent other rivals from getting better terms than Google does. Despite Meta accessing some of Google’s search data for its AI products, Turley said Google declined to share data with OpenAI.

What’s Next?

The DOJ is expected to call its last witness, Dr. Tasneem Chipty, on Tuesday, and then rest its case. Google’s witnesses, including Google’s CEO Sundar Pichai and Apple’s senior VP of services Eduardo Cue, are expected to rebut the DOJ’s experts, in which case the court may accommodate time for rebuttals from both the DOJ and Google.

Authors